How to build a Fraud Detection Model with Machine Learning

Hello, today we are going to create a machine learning model to detect credit cards frauds. We are interested to create a model to detect frauds from financial records. The models that we will use in this project are:

- Logistic Regression

- XGBoost

Introduction

An anomaly can be seen as data that deviates substantially from the norm. Anomaly detection is the process of identifying rare observations which differ substantially from the majority of the data from where they are drawn Applications include intrusion detection, fraud detection, fault detection, healthcare monitoring etc

Fraud Detection

- Fraud detection is the process of detecting anomalous financial records from within a broader set of normal transactions.

- The data is typically tabular in nature i.e. data sets with rows and columns.

- It is important to have access to histrorical instances of confirmed fraudulent behaviour i.e. labels or our target variable, which are often issued by a bank or third party.

-

Because fraud is by definition less frequent than normal behaviour within a financial services ecosystem, there will be far less confirmed historical instances of fraudulent behaviour compared with the known good/normal behaviour, leading to an imbalance between the fraudulent and non-fraudulent samples.

- Feature engineering is crucial, as it involves converting domain knowledge from fraud analysts and investigators into data that can be used to detect suspicious behaviours.

- The features/data is typically aggregated at the customer-level, or at the transaction-level, depending on the use-case. Some approaches even combine the two.

-

Network data i.e. how users within a system are connected to one another (if at all), is normally a strong indicator of fraudulent behaviour.

- Data sets for fraud detection are notoriously difficulty to access, due to various issues related to data privacy. There are some popular data sets available online, one of which is the ULB Machine Learning Group credit card fraud data set on Kaggle that we’ll be using throughout this blog.

Step 1. Installation of Conda

First you need to install anaconda at this link

in this location C:\Anaconda3 , then you, check that your terminal , recognize conda

C:\conda --version

conda 23.1.0

Step 2. Environment creation

The environments supported that I will consider is Python 3.8,

I will create an environment called detector, but you can put the name that you like.

conda create -n detector python==3.8

then we activate

conda activate detector

then in your terminal type the following commands:

conda install ipykernel

then

python -m ipykernel install --user --name detector --display-name "Python (Fraud Detector)"

then we install the

pip install pandas numpy xgboost scikit-learn imblearn streamlit matplotlib seaborn shap ipywidgets

Once we have created the environment you can download the repository

git clone https://github.com/ruslanmv/Fraud-Detection-Model-with-Machine-Learning.git

and later you can open the folder

cd Fraud-Detection-Model-with-Machine-Learning

and simple there you can create a simple notebooks with

jupyter notebook

and open a new Python Fraud Detector notebook.

Step 3. Loading Libraries

Inside the notebook we can load the libraries needed for this project

import pandas as pd

import os

import glob

from sklearn.linear_model import LogisticRegression

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

from sklearn.model_selection import train_test_split

from sklearn.metrics import confusion_matrix

import shap

import xgboost as xgb

from sklearn.metrics import (classification_report, precision_score, recall_score,

average_precision_score, roc_auc_score,

f1_score, matthews_corrcoef)

from imblearn.over_sampling import SMOTE

from collections import Counter

from sklearn.metrics import accuracy_score

Step 4. Data exploration

The dataset that we are going to use is the follow:

The dataset contains transactions made by credit cards in September 2013 by European cardholders. This dataset presents transactions that occurred in two days, where we have 492 frauds out of 284,807 transactions. The dataset is highly unbalanced, the positive class (frauds) account for 0.172% of all transactions.

It contains only numerical input variables which are the result of a PCA transformation. Unfortunately, due to confidentiality issues, we cannot provide the original features and more background information about the data. Features V1, V2, … V28 are the principal components obtained with PCA, the only features which have not been transformed with PCA are ‘Time’ and ‘Amount’. Feature ‘Time’ contains the seconds elapsed between each transaction and the first transaction in the dataset. The feature ‘Amount’ is the transaction Amount, this feature can be used for example-dependant cost-sensitive learning. Feature ‘Class’ is the response variable and it takes value 1 in case of fraud and 0 otherwise.

Given the class imbalance ratio, we measuring the accuracy using the Area Under the Precision-Recall Curve (AUPRC). Confusion matrix accuracy is not meaningful for unbalanced classification.

Due to in GitHub you cannot have files bigger then 25 mb I will load my splited dataset

#to get the current working directory

directory = os.getcwd()

directory=directory+'\\data'

all_files = glob.glob(os.path.join(directory, "*.csv"))

df = pd.concat((pd.read_csv(f) for f in all_files), ignore_index=True)

df.shape[0]

284807

df.head()

| Time | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | ... | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Amount | Class | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.0 | -1.359807 | -0.072781 | 2.536347 | 1.378155 | -0.338321 | 0.462388 | 0.239599 | 0.098698 | 0.363787 | ... | -0.018307 | 0.277838 | -0.110474 | 0.066928 | 0.128539 | -0.189115 | 0.133558 | -0.021053 | 149.62 | 0 |

| 1 | 0.0 | 1.191857 | 0.266151 | 0.166480 | 0.448154 | 0.060018 | -0.082361 | -0.078803 | 0.085102 | -0.255425 | ... | -0.225775 | -0.638672 | 0.101288 | -0.339846 | 0.167170 | 0.125895 | -0.008983 | 0.014724 | 2.69 | 0 |

| 2 | 1.0 | -1.358354 | -1.340163 | 1.773209 | 0.379780 | -0.503198 | 1.800499 | 0.791461 | 0.247676 | -1.514654 | ... | 0.247998 | 0.771679 | 0.909412 | -0.689281 | -0.327642 | -0.139097 | -0.055353 | -0.059752 | 378.66 | 0 |

| 3 | 1.0 | -0.966272 | -0.185226 | 1.792993 | -0.863291 | -0.010309 | 1.247203 | 0.237609 | 0.377436 | -1.387024 | ... | -0.108300 | 0.005274 | -0.190321 | -1.175575 | 0.647376 | -0.221929 | 0.062723 | 0.061458 | 123.50 | 0 |

| 4 | 2.0 | -1.158233 | 0.877737 | 1.548718 | 0.403034 | -0.407193 | 0.095921 | 0.592941 | -0.270533 | 0.817739 | ... | -0.009431 | 0.798278 | -0.137458 | 0.141267 | -0.206010 | 0.502292 | 0.219422 | 0.215153 | 69.99 | 0 |

5 rows × 31 columns

df.describe()

| Time | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | ... | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Amount | Class | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 284807.000000 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | ... | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 284807.000000 | 284807.000000 |

| mean | 94813.859575 | 1.168375e-15 | 3.416908e-16 | -1.379537e-15 | 2.074095e-15 | 9.604066e-16 | 1.487313e-15 | -5.556467e-16 | 1.213481e-16 | -2.406331e-15 | ... | 1.654067e-16 | -3.568593e-16 | 2.578648e-16 | 4.473266e-15 | 5.340915e-16 | 1.683437e-15 | -3.660091e-16 | -1.227390e-16 | 88.349619 | 0.001727 |

| std | 47488.145955 | 1.958696e+00 | 1.651309e+00 | 1.516255e+00 | 1.415869e+00 | 1.380247e+00 | 1.332271e+00 | 1.237094e+00 | 1.194353e+00 | 1.098632e+00 | ... | 7.345240e-01 | 7.257016e-01 | 6.244603e-01 | 6.056471e-01 | 5.212781e-01 | 4.822270e-01 | 4.036325e-01 | 3.300833e-01 | 250.120109 | 0.041527 |

| min | 0.000000 | -5.640751e+01 | -7.271573e+01 | -4.832559e+01 | -5.683171e+00 | -1.137433e+02 | -2.616051e+01 | -4.355724e+01 | -7.321672e+01 | -1.343407e+01 | ... | -3.483038e+01 | -1.093314e+01 | -4.480774e+01 | -2.836627e+00 | -1.029540e+01 | -2.604551e+00 | -2.256568e+01 | -1.543008e+01 | 0.000000 | 0.000000 |

| 25% | 54201.500000 | -9.203734e-01 | -5.985499e-01 | -8.903648e-01 | -8.486401e-01 | -6.915971e-01 | -7.682956e-01 | -5.540759e-01 | -2.086297e-01 | -6.430976e-01 | ... | -2.283949e-01 | -5.423504e-01 | -1.618463e-01 | -3.545861e-01 | -3.171451e-01 | -3.269839e-01 | -7.083953e-02 | -5.295979e-02 | 5.600000 | 0.000000 |

| 50% | 84692.000000 | 1.810880e-02 | 6.548556e-02 | 1.798463e-01 | -1.984653e-02 | -5.433583e-02 | -2.741871e-01 | 4.010308e-02 | 2.235804e-02 | -5.142873e-02 | ... | -2.945017e-02 | 6.781943e-03 | -1.119293e-02 | 4.097606e-02 | 1.659350e-02 | -5.213911e-02 | 1.342146e-03 | 1.124383e-02 | 22.000000 | 0.000000 |

| 75% | 139320.500000 | 1.315642e+00 | 8.037239e-01 | 1.027196e+00 | 7.433413e-01 | 6.119264e-01 | 3.985649e-01 | 5.704361e-01 | 3.273459e-01 | 5.971390e-01 | ... | 1.863772e-01 | 5.285536e-01 | 1.476421e-01 | 4.395266e-01 | 3.507156e-01 | 2.409522e-01 | 9.104512e-02 | 7.827995e-02 | 77.165000 | 0.000000 |

| max | 172792.000000 | 2.454930e+00 | 2.205773e+01 | 9.382558e+00 | 1.687534e+01 | 3.480167e+01 | 7.330163e+01 | 1.205895e+02 | 2.000721e+01 | 1.559499e+01 | ... | 2.720284e+01 | 1.050309e+01 | 2.252841e+01 | 4.584549e+00 | 7.519589e+00 | 3.517346e+00 | 3.161220e+01 | 3.384781e+01 | 25691.160000 | 1.000000 |

8 rows × 31 columns

df['Class'].value_counts()

0 284315

1 492

Name: Class, dtype: int64

It is important that credit card companies are able to recognize fraudulent credit card transactions so that customers are not charged for items that they did not purchase.

- Training algorithm would be overwhelmingly baised towards the majority class

- Would not be able to learn anything meaningful from the fraudulent minority class

- we can cater for the imbalance in a number of ways

- Up sample the minority class at training time (synthetic data)

- Down sample the majority class

- Choose an approach better suited to highly imbalanced data i.e. anomaly detection algorithms

- Re-balance the classes at training time using the algorithm’s class_weight hyperparameter to penalize the loss function more for misclassifications made on the minority class (hence improving the algorithm’s ability to learn the minority class)

Sampling with a Class Imbalance

- In machine learning, there are traditionally two main types of modelling approaches:

- Supervised learning (data has a label or target variable i.e. something to learning and correct itself from)

- Classification - predicting a categorical value i.e. is fraud yes/no

- Regression - predicting a continuous value i.e. price

- Unsupervised (data has no label)

- Clustering - find the natural groupings within the data

- Dimensionality reduction - reduce higher dimensional data set down to a lower dimensional space i.e. many columns down to fewer columns to potentially help improve model performance

- Supervised learning (data has a label or target variable i.e. something to learning and correct itself from)

- Fraud detection is typically a supervised, binary classification problem, but unsupervised learning (both clustering and PCA) can be used

- This data set represents a supervised learning problem (binary (yes/no) classification)

y = df['Class']

X = df.drop(['Class','Amount','Time'], axis=1)

Step 5. Model validation

- Train set which our model learns from

- Test set (unseen holdout set) which is used to evaluate the effectiveness of the model after training is complete

- Often a 80/20 or 90/10 split depending on the amount of data

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.1, random_state=42, stratify=y)

print("X_train:", X_train.shape)

print("X_test:", X_test.shape)

print("y_train:", y_train.shape)

print("y_test:", y_test.shape)

X_train: (256326, 28)

X_test: (28481, 28)

y_train: (256326,)

y_test: (28481,)

print("Fraud in y_train:", len(np.where(y_train == 1)[0]))

print("Fraud in y_test", len(np.where(y_test == 1)[0]))

Fraud in y_train: 443

Fraud in y_test 49

Step 6 - First model Logistic Regression Model

model = LogisticRegression(class_weight='balanced')

model.fit(X_train, y_train)

y_pred = model.predict(X_test)

y_pred

array([0, 0, 0, ..., 0, 0, 0], dtype=int64)

confusion_matrix(y_test, y_pred)

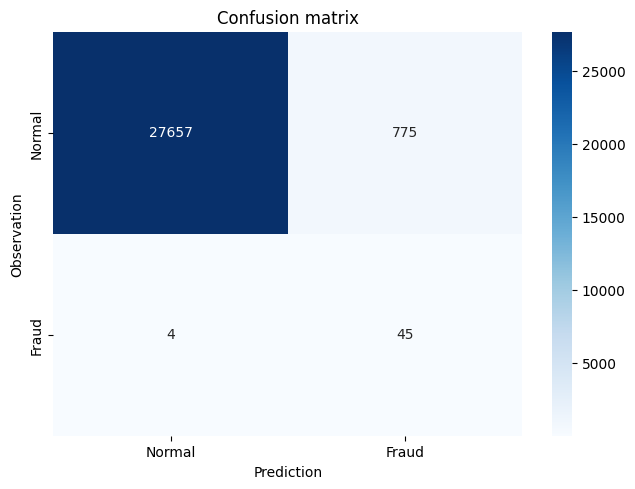

# Confusion Matrix plotting function

import itertools

def plot_confusion_matrix(cm,

title='Confusion matrix',

LABELS = ["Normal", "Fraud"],

cmap=plt.cm.Blues):

"""

This function prints and plots the confusion matrix.

"""

sns.heatmap(cm, xticklabels=LABELS, yticklabels=LABELS, annot=True, fmt="d",cmap=cmap)

plt.title(title)

plt.tight_layout()

plt.ylabel('Observation')

plt.xlabel('Prediction')

# This is the Sklearn Confusion Matrix code

confusion_mtx = confusion_matrix(y_test, y_pred)

# plot the confusion matrix

plot_confusion_matrix(confusion_mtx)

# AUROC/AUC = Area under the Receiver Operating Characteristic curve

roc_auc_score(y_test, y_pred)

0.9455546639027023

# AUPRC = Area under the Precision-Recall curve

average_precision_score(y_test, y_pred)

0.05053865257057752

Interpreting the Logistic Regression Model

# y = mx + c

# B_0 + B_1*x_1 + B_2*x_2 etc

model.coef_

array([[ 0.48400318, -0.46079153, 0.09736275, 1.16539782, 0.16291224,

-0.17368213, 0.08084814, -0.76005345, -0.68351754, -1.46873279,

0.6172841 , -1.3016 , -0.3970373 , -1.35726908, -0.08044446,

-0.93149893, -1.01520931, -0.24598021, 0.15143032, -0.35166739,

0.3869633 , 0.5860313 , -0.31382196, -0.13406144, -0.33186213,

-0.42679528, -0.20485846, 0.4507536 ]])

model.intercept_

array([-3.81460738])

model.predict_proba(X_test)

# true probabilities would require model calibration isotonic regression etc

# https://scikit-learn.org/stable/modules/calibration.html

array([[0.90172788, 0.09827212],

[0.9589293 , 0.0410707 ],

[0.96496459, 0.03503541],

...,

[0.94511721, 0.05488279],

[0.97703552, 0.02296448],

[0.94834977, 0.05165023]])

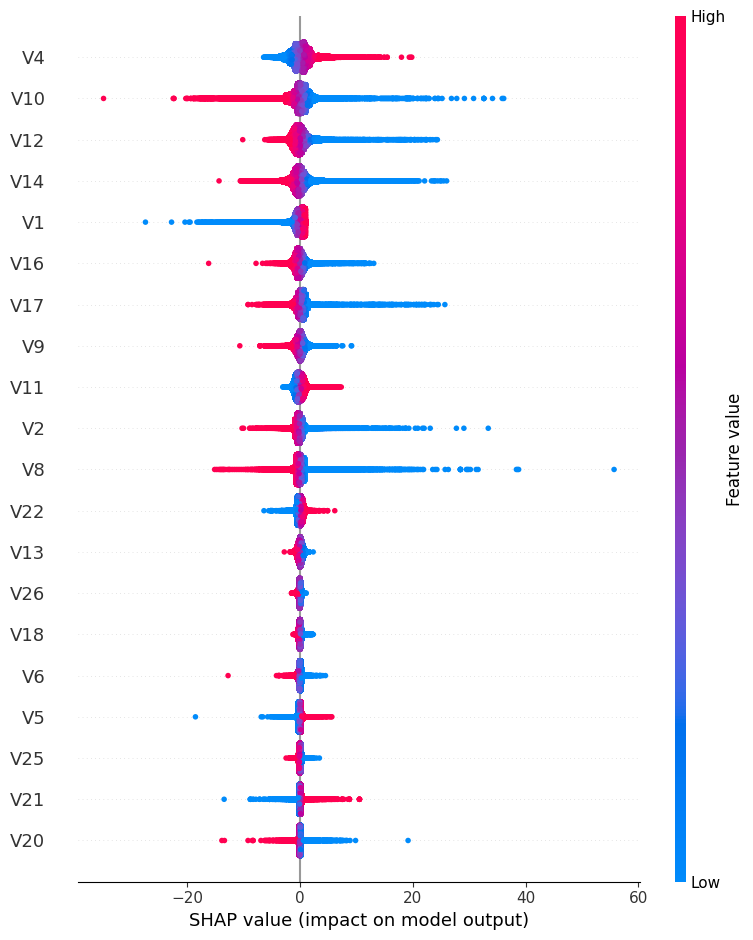

SHAP

- The Shapley value is the average expected marginal contribution of one feature after all possible feature combinations have been considered.

- Shapley value helps to determine a payoff for all of the features when each feature might have contributed more or less than the others.

shap.initjs()

explainer = shap.LinearExplainer(model, X_train)

shap_values = explainer.shap_values(X)

shap.summary_plot(shap_values, X)

No data for colormapping provided via 'c'. Parameters 'vmin', 'vmax' will be ignored

Step 7. - Second model XGBoost

XGBoost is a popular and efficient open-source implementation of the gradient boosted trees algorithm. Gradient boosting is a supervised learning algorithm, which attempts to accurately predict a target variable by combining the estimates of a set of simpler, weaker models.

model = xgb.XGBClassifier()

model.fit(X_train, y_train)

y_pred = model.predict(X_test)

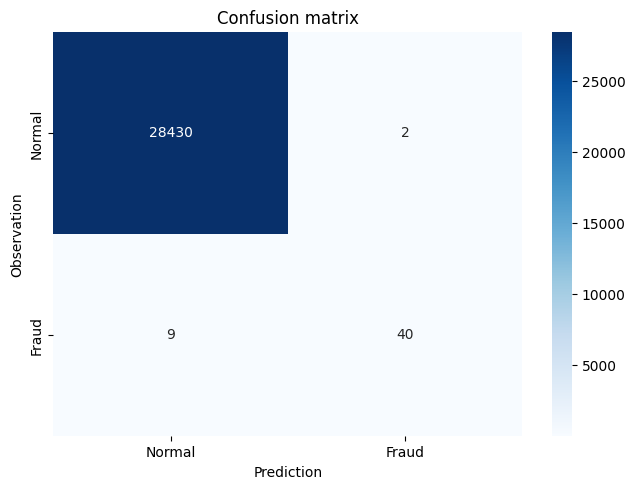

confusion_mtx=confusion_matrix(y_test, y_pred)

plot_confusion_matrix(confusion_mtx)

# AUROC/AUC = Area under the Receiver Operating Characteristic curve

roc_auc_score(y_test, y_pred)

0.9081280936685311

# AUPRC = Area under the Precision-Recall curve

average_precision_score(y_test, y_pred)

0.777769838818772

Improving the XGBoost Model through Hyperparameter Selection 1

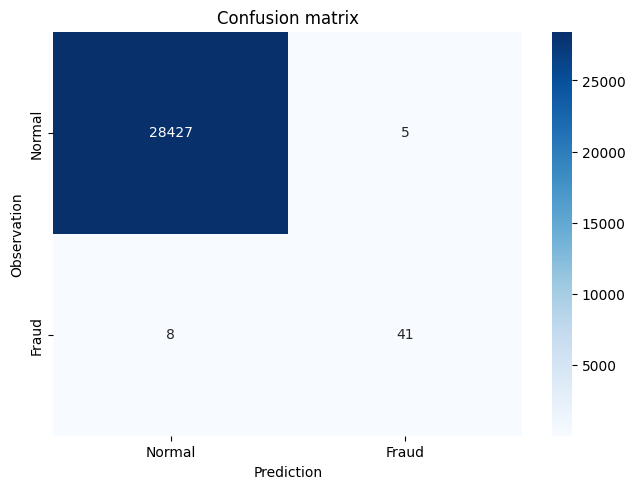

model = xgb.XGBClassifier(scale_pos_weight=100)

model.fit(X_train, y_train)

y_pred = model.predict(X_test)

y_pred

array([0, 0, 0, ..., 0, 0, 0])

confusion_mtx=confusion_matrix(y_test, y_pred)

plot_confusion_matrix(confusion_mtx)

# AUROC/AUC = Area under the Receiver Operating Characteristic curve

roc_auc_score(y_test, y_pred)

0.9182794178447969

# AUPRC = Area under the Precision-Recall curve

average_precision_score(y_test, y_pred)

0.7460661596437196

Improving the XGBoost Model through Hyperparameter Selection 2

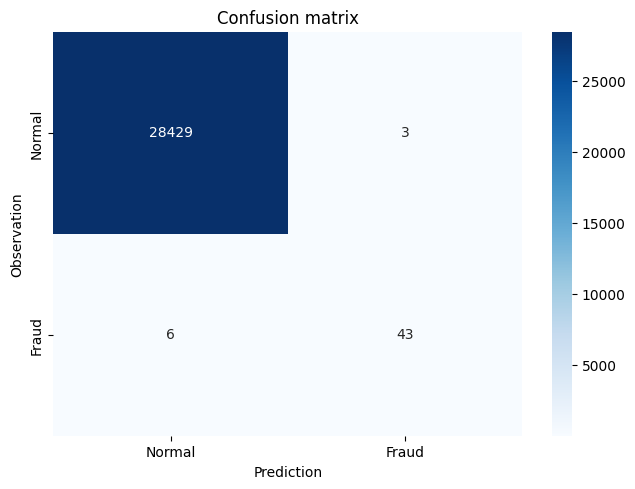

model = xgb.XGBClassifier(max_depth=5, scale_pos_weight=100)

# max_depth specifies the maximum depth to which each tree will be built.

# reduces overfitting

model.fit(X_train, y_train)

y_pred = model.predict(X_test)

confusion_mtx=confusion_matrix(y_test, y_pred)

plot_confusion_matrix(confusion_mtx)

# AUROC/AUC = Area under the Receiver Operating Characteristic curve

roc_auc_score(y_test, y_pred)

0.9387227527476945

# AUPRC = Area under the Precision-Recall curve

average_precision_score(y_test, y_pred)

0.8205300988809707

Interpreting the XGBoost Model

model.classes_

array([0, 1], dtype=int64)

model.feature_importances_

array([0.01778892, 0.006522 , 0.01161652, 0.04864641, 0.00839465,

0.01592866, 0.02007158, 0.02973094, 0.00941193, 0.04264095,

0.01003185, 0.02240502, 0.01880649, 0.52212244, 0.01488954,

0.00652269, 0.08942025, 0.00986922, 0.01701785, 0.01133021,

0.01525105, 0.0066182 , 0.01258562, 0.00372731, 0.00570192,

0.01185634, 0.00590739, 0.00518408], dtype=float32)

Accuracy

from sklearn.metrics import accuracy_score

y_pred_acc = np.zeros(len(y_test))

print('Accuracy Score:', round(accuracy_score(y_test, y_pred_acc), 5))

Accuracy Score: 0.99828

Implementing Performance Metrics in scikit-learn

Precision is the proportion of correctly predicted fraudulent instances among all instances predicted as fraud

# TP / TP + FP

# 43 / 3 + 43 = 0.934

precision_score(y_test, y_pred)

0.9347826086956522

Recall is the proportion of the fraudulent instances that are successfully predicted

# TP / TP + FN

# 43 / 6 + 43 = 0.877

recall_score(y_test, y_pred)

0.8775510204081632

F1-score is the harmonic balance of precision and recall (can be weighted more towards P or R if need be)

F = 2 * (Precision * Recall)/(Precision + Recall)

# F = 2 * (0.934 * 0.877)/(0.934 + 0.877)

# F = 0.905

f1_score(y_test, y_pred)

0.9052631578947369

- AUROC/AUC = Area under the Receiver Operating Characteristic curve

- plot the TPR (Recall) and FPR at various classification thresholds

- FPR = FP / FP + TN

- Good measure of overall performance

roc_auc_score(y_test, y_pred)

0.9387227527476945

- AUPRC = Area under the Precision-Recall curve

- Better alternative to AUC as doesn’t include TN which influences the scores significantly in highly imbalanced data

-

calculates the area under the curve at various classification thresholds

average_precision_score(y_test, y_pred)

0.8205300988809707

# Classification report summarizes the classification metrics at the class and overall level

print(classification_report(y_test, y_pred))

precision recall f1-score support

0 1.00 1.00 1.00 28432

1 0.93 0.88 0.91 49

accuracy 1.00 28481

macro avg 0.97 0.94 0.95 28481

weighted avg 1.00 1.00 1.00 28481

Threshold Optimization using Performance Metrics

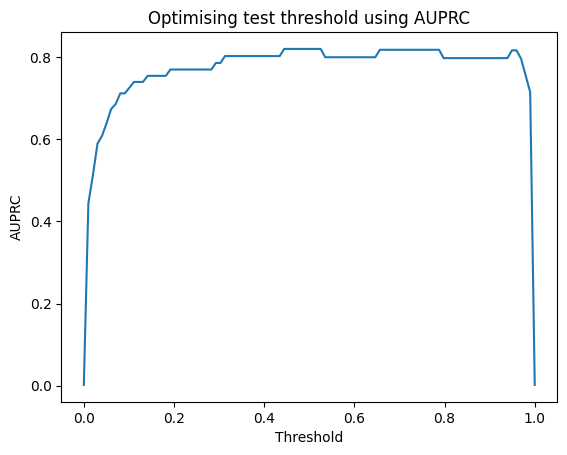

model_xgb = xgb.XGBClassifier(max_depth=5, scale_pos_weight=100)

model_xgb.fit(X_train, y_train)

y_pred = model_xgb.predict(X_test)

confusion_matrix(y_test, y_pred)

array([[28429, 3],

[ 6, 43]], dtype=int64)

# probability of being fraudulent

y_pred = model_xgb.predict_proba(X_test)[:,1]

y_pred

array([1.0238165e-05, 1.4227397e-05, 5.2480987e-06, ..., 2.7707663e-06,

1.6304925e-06, 8.0974127e-07], dtype=float32)

threshold_list = []

auprc_list = []

thresholds = np.linspace(0, 1, 100)

for threshold in thresholds:

y_pred_thresh = [1 if e > threshold else 0 for e in y_pred]

threshold_list.append(threshold)

# AUPRC

auprc_score = average_precision_score(y_test, y_pred_thresh)

auprc_list.append(auprc_score)

# plot curve

threshold_df = pd.DataFrame(threshold_list, auprc_list).reset_index()

threshold_df.columns = ['AUPRC', 'Threshold']

plt.plot(threshold_df['Threshold'], threshold_df['AUPRC'])

plt.title("Optimising test threshold using AUPRC")

plt.xlabel('Threshold')

plt.ylabel('AUPRC')

plt.savefig('Optimising threshold using AUPRC');

plt.show()

threshold_df.sort_values(by='AUPRC', ascending=False)

| AUPRC | Threshold | |

|---|---|---|

| 50 | 0.820530 | 0.505051 |

| 44 | 0.820530 | 0.444444 |

| 52 | 0.820530 | 0.525253 |

| 51 | 0.820530 | 0.515152 |

| 48 | 0.820530 | 0.484848 |

| ... | ... | ... |

| 3 | 0.589815 | 0.030303 |

| 2 | 0.513295 | 0.020202 |

| 1 | 0.444110 | 0.010101 |

| 0 | 0.001720 | 0.000000 |

| 99 | 0.001720 | 1.000000 |

100 rows × 2 columns

threshold_df.loc[(threshold_df['AUPRC'] >= 0.82)]

| AUPRC | Threshold | |

|---|---|---|

| 44 | 0.82053 | 0.444444 |

| 45 | 0.82053 | 0.454545 |

| 46 | 0.82053 | 0.464646 |

| 47 | 0.82053 | 0.474747 |

| 48 | 0.82053 | 0.484848 |

| 49 | 0.82053 | 0.494949 |

| 50 | 0.82053 | 0.505051 |

| 51 | 0.82053 | 0.515152 |

| 52 | 0.82053 | 0.525253 |

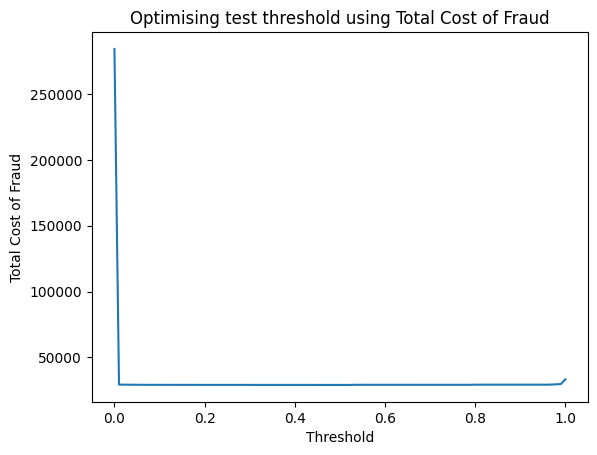

Threshold Optimization using Total Cost of Fraud

threshold_list = []

tcf_list = []

cost_tn = 1

cost_fp = 10

cost_fn = 100

cost_tp = 1

thresholds = np.linspace(0, 1, 100)

for threshold in thresholds:

y_pred_thresh = [1 if e > threshold else 0 for e in y_pred]

threshold_list.append(threshold)

# Total Cost of Fraud

conf_matrix_xgb = confusion_matrix(y_test, y_pred_thresh)

tcf_score = (conf_matrix_xgb[0][0] * cost_tn) + (conf_matrix_xgb[0][1] * cost_fp) + (conf_matrix_xgb[1][0] * cost_fn) + (conf_matrix_xgb[1][1] * cost_tp)

tcf_list.append(tcf_score)

# plot curve

threshold_df = pd.DataFrame(threshold_list, tcf_list).reset_index()

threshold_df.columns = ['TCF', 'Threshold']

plt.plot(threshold_df['Threshold'], threshold_df['TCF'])

plt.title("Optimising test threshold using Total Cost of Fraud")

plt.xlabel('Threshold')

plt.ylabel('Total Cost of Fraud')

plt.savefig('Optimising threshold using Total Cost of Fraud');

plt.show()

- if threshold = 0, then everything is fraud (lots of false positives which cost $10 each)

- if threshold = 1, then everything is non-fraudulent (quite a few missed cases of fraud which cost $100 each)

- optimal threshold for this model is around 50% (already well balanced)

threshold_df.sort_values(by='TCF', ascending=True)

| TCF | Threshold | |

|---|---|---|

| 49 | 29102 | 0.494949 |

| 52 | 29102 | 0.525253 |

| 51 | 29102 | 0.515152 |

| 50 | 29102 | 0.505051 |

| 47 | 29102 | 0.474747 |

| ... | ... | ... |

| 1 | 29381 | 0.010101 |

| 97 | 29579 | 0.979798 |

| 98 | 29777 | 0.989899 |

| 99 | 33332 | 1.000000 |

| 0 | 284369 | 0.000000 |

100 rows × 2 columns

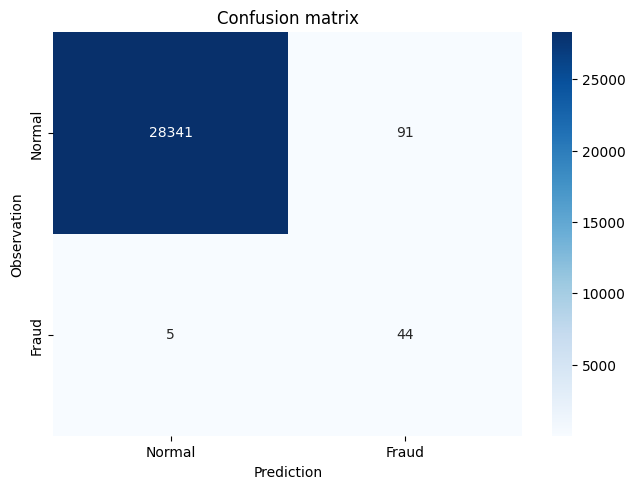

Up-sampling the Minority Class with SMOTE

y = df['Class']

X = df.drop(['Class','Amount','Time'], axis=1)

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.1, random_state=42, stratify=y)

model_xgb = xgb.XGBClassifier(max_depth=5, scale_pos_weight=100)

model_xgb.fit(X_train, y_train)

y_pred = model_xgb.predict(X_test)

confusion_matrix(y_test, y_pred)

array([[28429, 3],

[ 6, 43]], dtype=int64)

print('Original dataset shape %s' % Counter(y_train))

sm = SMOTE(sampling_strategy=1, random_state=42, k_neighbors=5)

# sampling_strategy = ratio of minority to majority after resampling

# k_neighbors = defines neighborhood of samples to use to generate synthetic samples. Decrease to reduce false positives.

X_res, y_res = sm.fit_resample(X_train, y_train)

print('Resampled dataset shape %s' % Counter(y_res))

Original dataset shape Counter({0: 255883, 1: 443})

Resampled dataset shape Counter({0: 255883, 1: 255883})

model_xgb = xgb.XGBClassifier(max_depth=5, scale_pos_weight=100)

model_xgb.fit(X_res, y_res)

y_pred = model_xgb.predict(X_test)

confusion_mtx=confusion_matrix(y_test, y_pred)

plot_confusion_matrix(confusion_mtx)

y_pred_acc = np.zeros(len(y_test))

print('Accuracy Score:', round(accuracy_score(y_test, y_pred_acc), 5))

Accuracy Score: 0.99828

# AUROC/AUC = Area under the Receiver Operating Characteristic curve

roc_auc_score(y_test, y_pred)

0.947379282326324

# AUPRC = Area under the Precision-Recall curve

average_precision_score(y_test, y_pred)

0.2928437340160444

# Classification report summarizes the classification metrics at the class and overall level

print(classification_report(y_test, y_pred))

precision recall f1-score support

0 1.00 1.00 1.00 28432

1 0.33 0.90 0.48 49

accuracy 1.00 28481

macro avg 0.66 0.95 0.74 28481

weighted avg 1.00 1.00 1.00 28481

Summary

Considering AUROC/AUC :Area under the Receiver Operating Characteristic curve and AUPRC: Area under the Precision-Recall curve we got the following results:

| Model | AUROC/AUC | AUPRC |

|---|---|---|

| Logistic Regression | 0.9456 | 0.0505 |

| XGBoost | 0.9081 | 0.7778 |

| XGBoost Model through Hyperparameter Selection 1 | 0.9183 | 0.7461 |

| XGBoost Model through Hyperparameter Selection 2 | 0.9387 | 0.8205 |

| Up-sampling the Minority Class with SMOTE | 0.9474 | 0.2928 |

Therefore the best model with higher Area under the Precision-Recall curve is XGBoost Model through Hyperparameter Selection 2 .

Congratulations! We have practiced how to create a fraud detector by using XGBoost and Logistic Regression models.

Leave a comment