Forecast of Natural Gas Price with Deep Learning

Hello everyone today I am going to predict the Natural Gas Price using Time Series with Long short-term memory (LSTM) Neural Networks. This project can be used to predict any times series data. In this blog we are going to give you a Real Prediction of the Gas Price of the next week.

The financial data that we will use is investpy that is one of the most complete Python packages when it comes to financial data extraction to stop relying on public/private APIs since investpy is free and has no limitations. Is one good of financial data retrieval.

Step 1. Creation of the environment

Installation of Conda

First you need to install anaconda at this link

I will create an environment called forecast, but you can put the name that you like.

conda create -n forecast python==3.7

If you are running anaconda for first time, you should init conda with the shell that you want to work, in this case I choose the cmd.exe

conda init cmd.exe

and then close and open the terminal

conda activate forecast

then in your terminal type the following commands:

conda install ipykernel

python -m ipykernel install --user --name forecast --display-name "Python (Forecast)"

Then we install Tensorflow

pip install tensorflow==2.9.0

and Keras

pip install keras==2.9.0

If you will work with Forecasting projects I suggest install additional libraries:

pip install statsmodels pandas matplotlib sklearn plotly nbformat seaborn

We need to install investpy which allows the user to download both recent and historical data from all the financial products indexed at Investing.com.

we type

pip install investpy

Step 2 Download the Recent/Historical Data Retrieval

The following notebook details the process of training a neural network with LSTM models.

import numpy as np

import pandas as pd

from statsmodels.tsa.statespace.sarimax import SARIMAX

from statsmodels.graphics.tsaplots import plot_acf,plot_pacf

from statsmodels.tsa.seasonal import seasonal_decompose

import matplotlib.pyplot as plt

from sklearn.metrics import mean_squared_error

from statsmodels.tools.eval_measures import rmse

import warnings

warnings.filterwarnings("ignore")

import time

from datetime import date

from datetime import datetime

today = date.today()

print("Today's date:", today)

to_today = datetime.strptime(str(today), '%Y-%m-%d').strftime('%d/%m/%Y')

to_date = datetime.strptime(str(today), '%Y-%m-%d').strftime('%Y-%m-%d')

Today's date: 2022-07-11

def addonDays(a, x):

ret = time.strftime("%Y-%m-%d",time.localtime(time.mktime(time.strptime(a,"%Y-%m-%d"))+x*3600*24+3600))

return ret

week_ago=addonDays(to_date, -7)

week_ago

'2022-07-04'

Searching the Financial Data

The search function allows the user to tune the parameters to adjust the search results to their needs, where both product types and countries from where the products are, can be specified.

For this project we are looking for the price of Natural Gas but also can be used to predict prices of Crude Oil, Gold, Silver, Copper, etc.

In the text we write what we want to predict, in this project we use Natural Gas.

import investpy

gas_result = investpy.search_quotes(text='Natural Gas', products=['stocks'],

countries=['united states'], n_results=1)

print(gas_result)

{"id_": 20413, "name": "Northwest Natural Gas Co", "symbol": "NWN", "country": "united states", "tag": "/equities/northwest-natural-gas-comp", "pair_type": "stocks", "exchange": "NYSE"}

Retrieved search results will be a list. those search results let the user retrieve both recent and historical data,

recent_data = gas_result.retrieve_recent_data()

print(recent_data.head())

Open High Low Close Volume Change Pct

Date

2022-06-13 53.31 53.56 51.28 51.51 214539 -4.77

2022-06-14 51.19 51.70 50.10 50.81 257471 -1.36

2022-06-15 50.94 51.63 50.51 50.81 337460 0.00

2022-06-16 50.28 51.01 49.69 50.86 428673 0.10

2022-06-17 51.43 51.99 50.56 51.69 1419987 1.63

Its information, the technical indicators, the default currency, etc., as presented in the piece of code below:

historical_data = gas_result.retrieve_historical_data(from_date='01/01/2022', to_date=to_today)

print(historical_data.head())

Open High Low Close Volume Change Pct

Date

2022-01-03 48.90 49.37 48.21 48.77 181573 -0.02

2022-01-04 49.10 49.79 49.08 49.35 131969 1.19

2022-01-05 49.47 49.89 49.24 49.57 126793 0.45

2022-01-06 49.72 49.74 49.27 49.54 130718 -0.06

2022-01-07 49.55 49.98 49.17 49.80 131915 0.52

information = gas_result.retrieve_information()

print(information)

{'prevClose': 52.06, 'dailyRange': '51.8-52.79', 'revenue': 894760000, 'open': 52.26, 'weekRange': '43.07-57.63', 'eps': 2.42, 'volume': 156807, 'marketCap': 1790000000, 'dividend': '1.93(3.71%)', 'avgVolume': 282206, 'ratio': 21.53, 'beta': 0.45, 'oneYearReturn': '0.12%', 'sharesOutstanding': 34255926, 'nextEarningDate': '11/08/2022'}

default_currency = gas_result.retrieve_currency()

print(default_currency)

USD

technical_indicators = gas_result.retrieve_technical_indicators(interval='daily')

print(technical_indicators)

indicator signal value

0 RSI(14) neutral 48.9150

1 STOCH(9,6) neutral 45.0020

2 STOCHRSI(14) oversold 19.5070

3 MACD(12,26) buy 0.2100

4 ADX(14) neutral 11.1960

5 Williams %R sell -60.4200

6 CCI(14) neutral -39.8620

7 ATR(14) less_volatility 1.3331

8 Highs/Lows(14) neutral 0.0000

9 Ultimate Oscillator buy 51.6290

10 ROC buy 1.4510

11 Bull/Bear Power(13) sell -0.9120

import investpy

hist = investpy.get_stock_historical_data(stock='NWN',

country='United States',

from_date='01/01/2022',

to_date=to_today)

print(hist.head())

Open High Low Close Volume Currency

Date

2022-01-03 48.90 49.37 48.21 48.77 181573 USD

2022-01-04 49.10 49.79 49.08 49.35 131969 USD

2022-01-05 49.47 49.89 49.24 49.57 126793 USD

2022-01-06 49.72 49.74 49.27 49.54 130718 USD

2022-01-07 49.55 49.98 49.17 49.80 131915 USD

import plotly.graph_objects as go

fig = go.Figure(data=go.Scatter(x=hist.index,y=hist['Close'], mode='lines'))

fig.update_layout(title={'text':gas_result.name+' ('+ default_currency +')', 'x':0.5})

fig.show()

.png)

Drawing an indicator 20 Day Moving Average, pandas provides convenient ways to calculate time series-related metrics such as the moving average. The df.rolling() method provides “moving windows” that we can operate on. To get the average of the moving window, we just need to add the .mean() at the end of the rolling() method.

from plotly.subplots import make_subplots

fig2 = make_subplots(specs=[[{"secondary_y": True}]])

fig2.add_trace(go.Candlestick(x=hist.index,

open=hist['Open'],

high=hist['High'],

low=hist['Low'],

close=hist['Close'],

))

fig2.add_trace(go.Scatter(x=hist.index,y=hist['Close'].rolling(window=20).mean(),marker_color='blue',name='20 Day MA'))

fig2.add_trace(go.Bar(x=hist.index, y=hist['Volume'], name='Volume'),secondary_y=True)

fig2.update_layout(title={'text':gas_result.name+' ('+ default_currency +')', 'x':0.5})

fig2.update_yaxes(range=[0,1000000000],secondary_y=True)

fig2.update_yaxes(visible=False, secondary_y=True)

fig2.update_layout(xaxis_rangeslider_visible=False) #hide range slider

fig2.show()

.png)

Step 3 Creation of Dataframe

hist['Date'] = hist.index

df = hist[["Date", "Close"]]

df=df.reset_index(drop=True)

df.head()

| Date | Close | |

|---|---|---|

| 0 | 2022-01-03 | 48.77 |

| 1 | 2022-01-04 | 49.35 |

| 2 | 2022-01-05 | 49.57 |

| 3 | 2022-01-06 | 49.54 |

| 4 | 2022-01-07 | 49.80 |

df.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 130 entries, 0 to 129

Data columns (total 2 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Date 130 non-null datetime64[ns]

1 Close 130 non-null float64

dtypes: datetime64[ns](1), float64(1)

memory usage: 2.2 KB

df.Date = pd.to_datetime(df.Date)

df = df.set_index("Date")

df.head()

| Close | |

|---|---|

| Date | |

| 2022-01-03 | 48.77 |

| 2022-01-04 | 49.35 |

| 2022-01-05 | 49.57 |

| 2022-01-06 | 49.54 |

| 2022-01-07 | 49.80 |

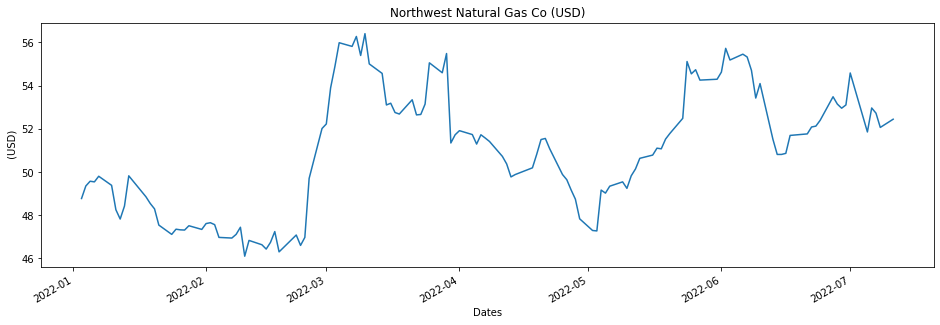

ax = df['Close'].plot(figsize = (16,5), title = gas_result.name+' ('+ default_currency +')')

ax.set(xlabel='Dates', ylabel=' ('+ default_currency +')');

This is the plot of the prices of the Natural Gas

Step 4 LSTM model training

Pre-processing data with MinMaxScaler

from sklearn.model_selection import train_test_split

train_data, test_data = train_test_split(df, test_size=0.2)

from sklearn.preprocessing import MinMaxScaler

scaler = MinMaxScaler()

scaler.fit(train_data)

scaled_train_data = scaler.transform(train_data)

scaled_test_data = scaler.transform(test_data)

Before creating the LSTM model, we need to create a Time Series Generator object.

from keras.preprocessing.sequence import TimeseriesGenerator

# Let's redefine to get 24 days back and then predict the next day out

n_input = 24

n_features= 1

generator = TimeseriesGenerator(scaled_train_data, scaled_train_data,

length=n_input, batch_size=1)

Example of transformation

X,y = generator[0]

print(f'Given the Array: \n{X.flatten()}')

print(f'Predict this y: \n {y}')

Given the Array:

[0.31456311 0.52427184 0.36116505 0.25631068 0.2368932 0.79126214

0.82427184 0.1368932 0.91067961 0.3592233 0.81941748 0.82330097

0.52524272 0.6368932 1. 0.11747573 0.12135922 0.61553398

0.70291262 0.14660194 0.54563107 0.20873786 0.90194175 0.08446602]

Predict this y:

[[0.39223301]]

Long short-term memory (LSTM)

Long short-term memory is an artificial neural network used in the fields of artificial intelligence and deep learning. Unlike standard feedforward neural networks, LSTM has feedback connections. Such a recurrent neural network can process not only single data points, but also entire sequences of data.

We are going to present two models of LSTM, one with a Single LSTM contribution and with Double LSTM contribution.

Step 6 - Single LSTM Model

from keras.models import Sequential

from keras.layers import Dense

from keras.layers import LSTM

lstm_model = Sequential()

lstm_model.add(LSTM(50, activation='relu', input_shape=(n_input, n_features)))

lstm_model.add(Dense(1))

lstm_model.compile(optimizer='adam', loss='mse')

lstm_model.summary()

WARNING:tensorflow:Layer lstm will not use cuDNN kernels since it doesn't meet the criteria. It will use a generic GPU kernel as fallback when running on GPU.

Model: "sequential"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm (LSTM) (None, 50) 10400

dense (Dense) (None, 1) 51

=================================================================

Total params: 10,451

Trainable params: 10,451

Non-trainable params: 0

_________________________________________________________________

lstm_model.fit_generator(generator,epochs=20)

Epoch 1/20

80/80 [==============================] - 9s 97ms/step - loss: 0.1017

Epoch 2/20

.

.

.

80/80 [==============================] - 8s 96ms/step - loss: 0.0722

Epoch 20/20

80/80 [==============================] - 9s 107ms/step - loss: 0.0717

<keras.callbacks.History at 0x1bf63d0e518>

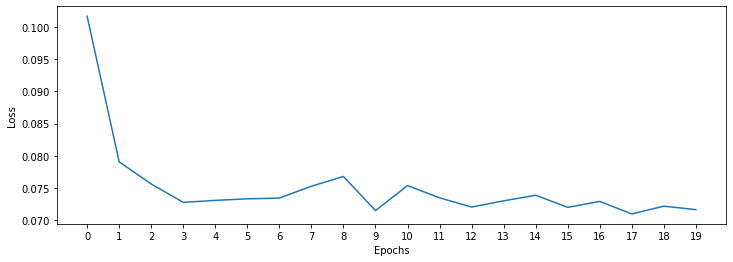

losses_lstm = lstm_model.history.history['loss']

plt.figure(figsize=(12,4))

plt.xlabel("Epochs")

plt.ylabel("Loss")

plt.xticks(np.arange(0,21,1))

plt.plot(range(len(losses_lstm)),losses_lstm);

Step 7 -Prediction on test data

Next we are going to make a prediction for 12 days (12 predictions). To do this we will do the following:

- create an empty list for each of our 12 predictions

- create the batch that our model will predict

- save the prediction in our list

- add the prediction to the end of the batch to use it in the next prediction

lstm_predictions_scaled = list()

batch = scaled_train_data[-n_input:]

current_batch = batch.reshape((1, n_input, n_features))

for i in range(len(test_data)):

lstm_pred = lstm_model.predict(current_batch)[0]

lstm_predictions_scaled.append(lstm_pred)

current_batch = np.append(current_batch[:,1:,:],[[lstm_pred]],axis=1)

1/1 [==============================] - 0s 164ms/step

.

.

.

1/1 [==============================] - 0s 20ms/step

1/1 [==============================] - 0s 25ms/step

As you know, we scale our data, so we have to invert it to see true predictions.

lstm_predictions_scaled

[array([0.41446185], dtype=float32),

array([0.4108159], dtype=float32),

.

.

.

array([0.40563506], dtype=float32)]

lstm_predictions = scaler.inverse_transform(lstm_predictions_scaled)

lstm_predictions

array([[50.36895707],

[50.33140371],

.

.

.

[50.27945744],

[50.27830387],

[50.27804111]])

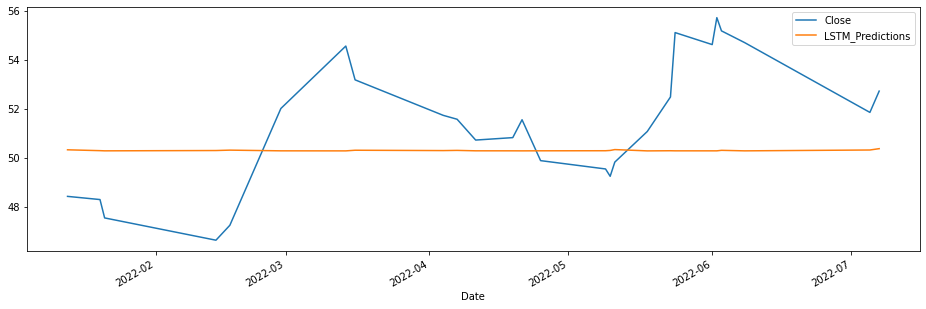

test_data['LSTM_Predictions'] = lstm_predictions

test_data['Close'].plot(figsize = (16,5), legend=True)

test_data['LSTM_Predictions'].plot(legend = True);

lstm_rmse_error = rmse(test_data['Close'], test_data["LSTM_Predictions"])

lstm_mse_error = lstm_rmse_error**2

mean_value = df['Close'].mean()

print(f'MSE Error: {lstm_mse_error}\nRMSE Error: {lstm_rmse_error}\nMean: {mean_value}')

MSE Error: 7.840908820950428

RMSE Error: 2.8001622847525156

Mean: 50.96569230769231

Step 6 -Double LSTM Model

from keras.models import Sequential

from keras.layers import Dense

from keras.layers import LSTM

from keras.callbacks import ModelCheckpoint

from keras.layers import Dropout

lstm_model = Sequential()

lstm_model.add(LSTM(200, activation='relu',return_sequences=True,

input_shape=(n_input, n_features)))

lstm_model.add(LSTM(200, return_sequences=True))

lstm_model.add(Dropout(rate=0.2))

lstm_model.add(LSTM(200, return_sequences=False))

lstm_model.add(Dense(1))

mc = ModelCheckpoint('double_model_lstm.h5', monitor='val_loss', mode='min',

verbose=1, save_best_only=True)

lstm_model.summary()

WARNING:tensorflow:Layer lstm_1 will not use cuDNN kernels since it doesn't meet the criteria. It will use a generic GPU kernel as fallback when running on GPU.

Model: "sequential_1"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_1 (LSTM) (None, 24, 200) 161600

lstm_2 (LSTM) (None, 24, 200) 320800

dropout (Dropout) (None, 24, 200) 0

lstm_3 (LSTM) (None, 200) 320800

dense_1 (Dense) (None, 1) 201

=================================================================

Total params: 803,401

Trainable params: 803,401

Non-trainable params: 0

_________________________________________________________________

lstm_model.compile(optimizer='adam', loss='mse')

lstm_model.fit_generator(generator,epochs=20)

Epoch 1/20

80/80 [==============================] - 14s 116ms/step - loss: 0.1063

Epoch 2/20

80/80 [==============================] - 10s 122ms/step - loss: 0.0803

Epoch 3/20

.

.

.

Epoch 19/20

80/80 [==============================] - 11s 133ms/step - loss: 0.0735

Epoch 20/20

80/80 [==============================] - 11s 139ms/step - loss: 0.0744

<keras.callbacks.History at 0x1bf6a9dae48>

Step 7 -EarlyStopping y Validation Generator

from tensorflow.keras.callbacks import EarlyStopping

early_stop = EarlyStopping(monitor='val_loss',

patience=12)

validation_generator = TimeseriesGenerator(scaled_test_data,scaled_test_data,

length=n_input)

lstm_model.compile(optimizer='adam',

loss='mse')

# fit model

lstm_model.fit_generator(generator,epochs=20,

validation_data=validation_generator,

callbacks=[early_stop, mc])

Epoch 1/20

80/80 [==============================] - ETA: 0s - loss: 0.0759

Epoch 1: val_loss improved from inf to 0.08796, saving model to double_model_lstm.h5

80/80 [==============================] - 15s 145ms/step - loss: 0.0759 - val_loss: 0.0880

Epoch 2/20

80/80 [==============================] - ETA: 0s - loss: 0.0773

.

.

.

Epoch 15/20

80/80 [==============================] - ETA: 0s - loss: 0.0694

Epoch 15: val_loss did not improve from 0.04324

80/80 [==============================] - 9s 117ms/step - loss: 0.0694 - val_loss: 0.2474

<keras.callbacks.History at 0x1bf6a830160>

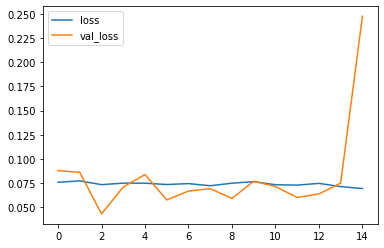

Learning curve

losses = pd.DataFrame(lstm_model.history.history)

losses.plot()

<AxesSubplot:>

from keras.models import load_model

lstm_model = load_model('double_model_lstm.h5', compile=False)

WARNING:tensorflow:Layer lstm_1 will not use cuDNN kernels since it doesn't meet the criteria. It will use a generic GPU kernel as fallback when running on GPU.

Step 8 -Prediction on test data

lstm_predictions_scaled = list()

batch = scaled_train_data[-n_input:]

current_batch = batch.reshape((1, n_input, n_features))

for i in range(len(test_data)):

# get prediction 1 time stamp ahead ([0] is for grabbing just the number instead of [array])

lstm_pred = lstm_model.predict(current_batch)[0]

# store prediction

lstm_predictions_scaled.append(lstm_pred)

# update batch to now include prediction and drop first value

current_batch = np.append(current_batch[:,1:,:],[[lstm_pred]],axis=1)

1/1 [==============================] - 1s 684ms/step

1/1 [==============================] - 0s 27ms/step

.

.

.

1/1 [==============================] - 0s 30ms/step

1/1 [==============================] - 0s 25ms/step

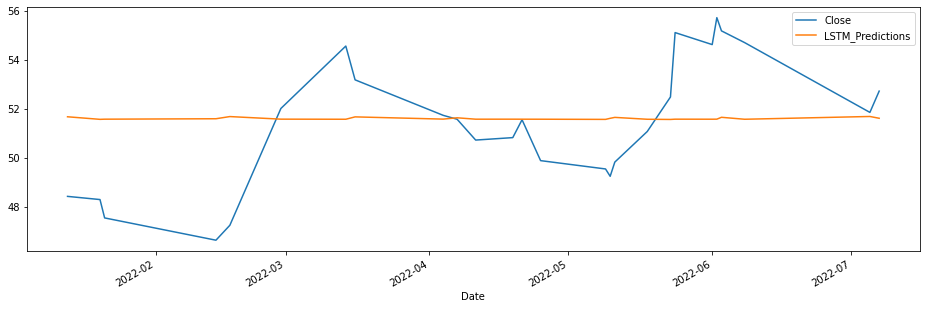

As you know, we scale our data, so we have to invert it to see true predictions.

Reverse the transformation

lstm_predictions = scaler.inverse_transform(lstm_predictions_scaled)

test_data['LSTM_Predictions'] = lstm_predictions

test_data['Close'].plot(figsize = (16,5), legend=True)

test_data['LSTM_Predictions'].plot(legend = True);

lstm_rmse_error = rmse(test_data['Close'], test_data["LSTM_Predictions"])

lstm_mse_error = lstm_rmse_error**2

mean_value = df['Close'].mean()

print(f'MSE Error: {lstm_mse_error}\nRMSE Error: {lstm_rmse_error}\nMean: {mean_value}')

MSE Error: 6.697523292919587

RMSE Error: 2.587957359177231

Mean: 50.96569230769231

Step 9 - Real Prediction of the Gas Price of the next week

Let us assume that we want to predict the price of the gas of the next week.

df.head()

| Close | |

|---|---|

| Date | |

| 2022-01-03 | 48.77 |

| 2022-01-04 | 49.35 |

| 2022-01-05 | 49.57 |

| 2022-01-06 | 49.54 |

| 2022-01-07 | 49.80 |

full_scaler = MinMaxScaler()

scaled_full_data = full_scaler.fit_transform(df)

length = 7 # Length of the output sequences (in number of timesteps)

generator = TimeseriesGenerator(scaled_full_data, scaled_full_data, length=length, batch_size=1)

model = Sequential()

model.add(LSTM(100, activation='relu', input_shape=(length, n_features)))

model.add(Dense(1))

model.compile(optimizer='adam', loss='mse')

# fit model

model.fit_generator(generator,epochs=8)

WARNING:tensorflow:Layer lstm_4 will not use cuDNN kernels since it doesn't meet the criteria. It will use a generic GPU kernel as fallback when running on GPU.

Epoch 1/8

123/123 [==============================] - 6s 43ms/step - loss: 0.0634

.

.

.

Epoch 8/8

123/123 [==============================] - 5s 39ms/step - loss: 0.0135

<keras.callbacks.History at 0x1c13b4f9b38>

forecast = []

# Replace periods with whatever forecast length you want

#one week

periods = 7

first_eval_batch = scaled_full_data[-length:]

current_batch = first_eval_batch.reshape((1, length, n_features))

for i in range(periods):

# get prediction 1 time stamp ahead ([0] is for grabbing just the number instead of [array])

current_pred = model.predict(current_batch)[0]

# store prediction

forecast.append(current_pred)

# update batch to now include prediction and drop first value

current_batch = np.append(current_batch[:,1:,:],[[current_pred]],axis=1)

1/1 [==============================] - 0s 140ms/step

1/1 [==============================] - 0s 21ms/step

1/1 [==============================] - 0s 17ms/step

1/1 [==============================] - 0s 17ms/step

1/1 [==============================] - 0s 23ms/step

1/1 [==============================] - 0s 19ms/step

1/1 [==============================] - 0s 18ms/step

forecast = scaler.inverse_transform(forecast)

test_data.tail()

| Close | LSTM_Predictions | |

|---|---|---|

| Date | ||

| 2022-01-21 | 47.54 | 51.572930 |

| 2022-04-21 | 51.55 | 51.572321 |

| 2022-06-08 | 54.70 | 51.570076 |

| 2022-03-14 | 54.56 | 51.570197 |

| 2022-05-18 | 51.07 | 51.569831 |

week_ago=addonDays(to_date, -7)

next_week=addonDays(to_date, 7)

next_month=addonDays(to_date, 30)

forecast_index = pd.date_range(start=to_date,periods=periods,freq='D')

forecast_index

DatetimeIndex(['2022-07-11', '2022-07-12', '2022-07-13', '2022-07-14',

'2022-07-15', '2022-07-16', '2022-07-17'],

dtype='datetime64[ns]', freq='D')

forecast_df = pd.DataFrame(data=forecast,index=forecast_index,

columns=['Forecast'])

forecast_df

| Forecast | |

|---|---|

| 2022-07-11 | 52.077826 |

| 2022-07-12 | 51.977773 |

| 2022-07-13 | 51.993099 |

| 2022-07-14 | 51.897952 |

| 2022-07-15 | 51.862930 |

| 2022-07-16 | 51.860414 |

| 2022-07-17 | 51.833954 |

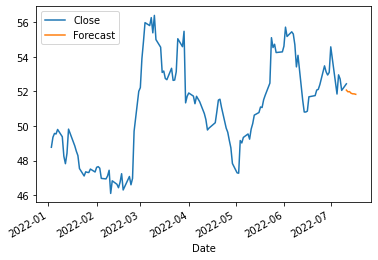

ax = df.plot()

forecast_df.plot(ax=ax)

<AxesSubplot:xlabel='Date'>

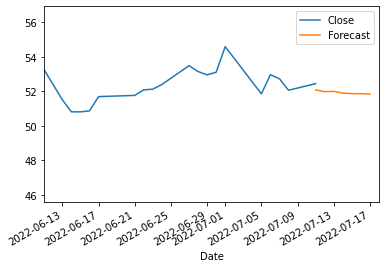

month_ago=addonDays(to_date, -30)

ax = df.plot()

forecast_df.plot(ax=ax)

plt.xlim(month_ago,next_week)

(19154.0, 19191.0)

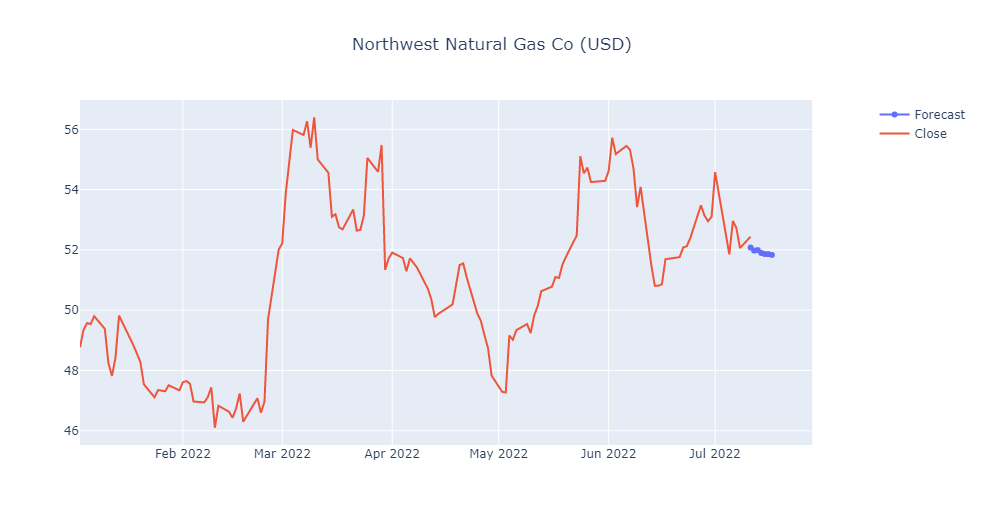

fig3 = make_subplots(specs=[[{"secondary_y": True}]])

fig3.add_trace(go.Scatter(x=forecast_df.index,y=forecast_df['Forecast'],name='Forecast'))

fig3.add_trace(go.Scatter(x=df.index,y=df['Close'],name='Close'))

fig3.update_layout(title={'text':gas_result.name+' ('+ default_currency +')', 'x':0.5})

fig3.update_yaxes(range=[0,1000000000],secondary_y=True)

fig3.update_yaxes(visible=False, secondary_y=True)

fig3.update_layout(xaxis_rangeslider_visible=False) #hide range slider

fig3.show()

You can download the notebook here or you can run it on Google Colab .

Congratulations! We have created a Neural Network by using LSTM and we have predict the Natural Gas for one week.

Leave a comment